Mobile phones are reaching an unprecedented number of individuals in regions such as Africa and Southeast Asia, with nearly 880 million new connections expected by 2020 (according to a 2014 report by GSMA). This penetration into impoverished urban centers and remote rural villages means that individuals formerly cut-off from basic financial services such as cash flow statements or credit can now be reached through a touch of a button. InVenture is leveraging this technological transformation to make financial tracking and loan applications as easy as possible for the emerging middle class.

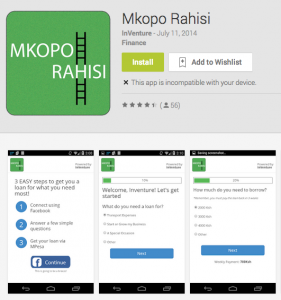

Our operations currently exist in Kenya, India and South Africa. In Kenya we’ve launched a new experimental mobile application called “Mkopo Rahisi,” which instantly scores individuals and offers affordable loans for individuals who lack access to formal financial services. Our simple application and approval process gives individuals access to funds when they need it the most: whether they are between pay checks or using our loan for a business pursuit, our borrowers rely on our services to smooth the erratic income and spending that they face in their daily lives.

So far we have received immense demand from our target market in Kenya. Our no-collateral policy makes our loans more accessible to individuals who do not have assets to risk in exchange for additional funds. In the past three months, we’ve seen 81% of our current Mkopo Rahisi customers stay with our services, coming back for repeat loans with repayment rates of 87% and above. Our customer acquisition cost is also very low (around $0.68 per borrower) because our referral rate is very high. The most common comment we receive in our product reviews is that Kenyans are thankful for our innovative and affordable approach to lending and are excited about their future collaboration with our company.

In the two years since we participated in the Vodafone Wireless Innovation Project, we have managed to develop the perfect product for our market through the recognition and funding that comes with their award. This was particularly important in our early days, since concept testing and rapid prototyping are a mandatory first step in assessing demand within our hard to reach target markets. The prestige of the prize also opened doors for us with research organizations and established financial institutions so we could quickly validate our credit scoring algorithms.

After our exciting initial lending results in Kenya, we look forward to working with other service providers to further open the financial services market to base of the pyramid customers. Our next steps include expanding into neighboring markets and partnering with additional organizations in India and South Africa. The combined proliferation of mobile phones and importance of data science presents a huge opportunity for social ventures to unlock neglected markets around the world. Here at InVenture, we are working hard to give people access to formal markets and to empower them to build their own future. These individuals, in turn, will build economies where even more people can flourish.